Discounted Cash Flow Learnings

A DCF for Meta in 2024. This was recommended to me as an exercise in learning the basics of investing and business. These are my (high level) notes of what I learned along the way.

What is a DCF

A DCF (Discounted Cash Flow) is a way of valuing a company’s stock by taking into account various factors. At a high level DCF works by projecting out the amount of cash a company will make in the future and discounting that back to the present. This is based off of the idea that money now is worth more than money in the future due to inflation (time value of money or TVM).

I’m going to walk through a DCF for Meta as an example. Because Meta is a publicly traded US company, it has 10ks that will provide a lot of the info needed to construct this valuation.

Forecast Free Cash Flow

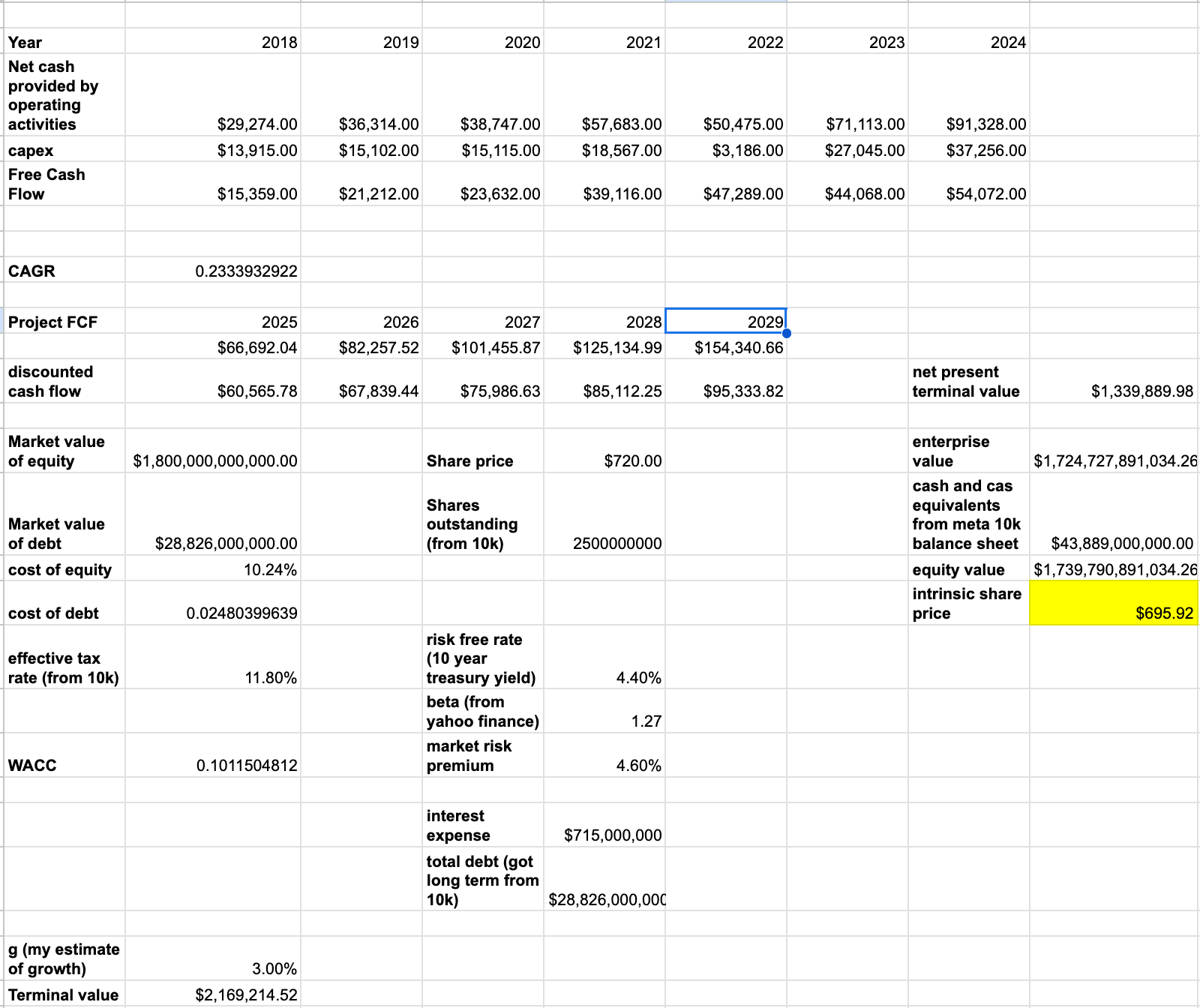

The core idea of DCF is to calculate how much money we think the company will make in the future and discount that back. Forecasting the free cash flow is the part where we calculate how much money we think the company will make. There are several ways to do this. The way I chose to do this was by getting the historical financial data of Meta since 2018 and calculating the free cash flow.

One concept that took me a while to wrap my head around was the concept of cash flow vs revenue. The explanation that I found that made the most sense is that cash flow only represents cash while revenue represents non cash items like depreciation and amortization and employee stock compensation.

I then use the Compound Annual Growth Rate (CAGR) formula with this historical free cash flow data to get an estimate for what the growth rate for my projected period will be.

This CAGR value is then applied each year starting with the 2024 Free Cash Flow until 2029, my projected end.

Discount Rate (WACC)

Now we need to actually calculate the value that we will be discounting these companies by. One way is to calculate the Weighted Average Cost of Capital (i.e. WACC). Conceptually the WACC represents the minimum return requried to justify an investment. The WACC calculation itself is a weighted average of the cost of equity and the cost of debt. Equity (selling shares) and debt (borrowing money) are the two ways that a company can raise money.

We can get the market value of equity by taking the share price and multiplying it by all the outstanding shares. We can get the debt value from the company’s balance sheet in its 10k.

Equity has a cost because investors are taking a risk. To get an estimate for the cost of equity, we can use the CAPM formula. This is the sum of the baseline you’d get with zero risk plus the expected market return multipled by the volatility of the stock relative to the market.

The cost of debt, what the company pays lender for borrowing money, is calculated by the interest expense (how much the company paid in interest during 2024) divided by the total amount owed by the company. Conceptually this value is, for every dollar of debt Meta has, how much interest is it paying annually.

Terminal Value

There is also a concept of terminal value in DCF. This is because we need some way of taking into account a company’s value past the projected date. We use the Gordon Growth Model (which assumes constant growth rate in perpetuity). One of the reasons for using this Terminal Value instead of projecting free cash flow infinitely into the future is because the constant growth rate is a simpler calculation that is less speculative and error prone (makes more conservative and simpler assumptions about the future that are more likely to be accurate).

Discount Calculations

We then discount each of the projected free cash flows and the terminal value back to the present. This gives us the enterprise value, representing the total value of the business. We then subtract debt (which belongs to lenders) and add cash (which belongs to equity holders) to get the equity value.

We then divide the equity value by the total number of shares understanding to get our estimate for the intrinsic share price.

Final Example

Here’s a screenshot of the full DCF for Meta:

Follow up

- Learn about more concepts (e.g. P/E ratio, relative valuations) and how to take that into account when valuing a company

- Look into automation